With the growth and increase in online shopping and the number of products available, the modes of payment for such purchases have also evolved. You now are no longer required to pay upfront in cash. One method that is rapidly gaining popularity among youth is EMI. EMI was first introduced as a payment mode only available for people owning a credit card. However, not everyone gets approved for a credit card, making the availability of products for all rather difficult.

Soon, banks and financial institutions came up with the EMI option for debit cardholders as well. A debit card is like carrying your savings or current account with you. It is directly linked to your bank account and every purchase you make is debited automatically. Although, certain rules come into play when you opt for a debit card EMI.

But first, what exactly is EMI on a debit card

EMI’s or Equated Monthly Instalments are a way to pay for all your expensive purchases over a reasonable tenure. Through this, you can make regular payments towards a product while actually having it. With this, you can convert all your high-value transactions into easy installments using your debit card.

How does it work

The EMI process is fairly simple. Each bank has a certain minimum amount of purchase that you need to make to be eligible for EMI. Once this figure is reached or surpassed, you will get an option on the payment page to make payment through debit card EMI. There, you can choose the tenure you want, which will also determine how much interest you will pay and what your final amount will look like.

What you should know is that banks charge a premium on every debit card EMI based on the size of your purchase, your bank balance, and your relationship with your bank. This is in the form of interest along with other charges such as a processing fee. Always check for a no-cost EMI while choosing a tenure.

Once you select an option you like, you will be asked to enter your card details and validate them with an OTP. It cannot be stressed that you should not share your OTP, card CVV number, and other details with anyone over the phone. Banks never ask for this personal information over the phone.

Once your details are validated, the entire purchase amount will be deducted from your account. After 2-3 days, your money will be credited back into your account and the payment will be converted to an EMI. The time it takes for the money to come back into your account is usually between 48 and 96 hours, depending on your bank.

Who is eligible

However easy it is to use, not everyone is eligible for EMI on debit cards. Only select customers are offered this facility from banks. The initial shortlist of customers is formed by the merchants, which is then approved by the banks. Even for such eligible is eligible

One key feature of debit card EMIs is that your bank auto approves customers for this payment method. Therefore, if you are eligible or not, you will already know beforehand.

Benefits of debit card EMI:

- Many banks and financial institutions have started offering flexible and attractive EMI plans. This ranges from no-cost EMI mobiles plans to longer tenures up to 3 years.

- You no longer have to apply for a credit card for the sake of a big purchase. Instead, you can avail an EMI plan on your debit card.

- It helps you purchase everything you want without going over your payment capacity as credit cards do.

Also read about:

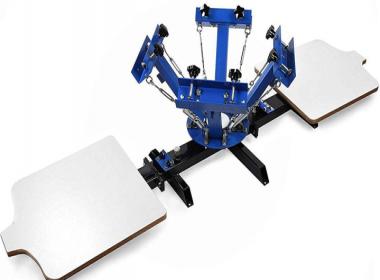

Screen Printing Machines Useful Tips to Choose the Best

A Guide To Database Management System Assignment Help

How to Buy a Computer A Comprehensive Guide for Novices